Inside the Low-Cap Alpha Signal Bot: Architecture, Logic & Design

Engineering a Curated Solana Signal Into a Live, Low-Latency Trading System

This post breaks down how I engineered a discrete, curated on-chain signal into a production trading system with paper and live modes, strong safety guardrails, and a tight research/ops feedback loop. It’s written for traders, quants, and engineers.

Nothing here is financial advice. Always test in simulation first.

Why a Discrete, Curated Signal Works

- Binary and Observable. The system keys off a discrete “go/no-go” event tied to a token’s lifecycle. It functions as a high-intent, quality-screened trigger rather than a raw firehose of noise.

- Flow-Compatible. The trigger is validated against real-time flow gates (5-minute volume, buy/sell balance, minimum number of buys) to isolate genuine participation.

- Execution-Aware Edge. In illiquid microcap regimes, slippage, impact, and exit discipline decide profitability. A curated trigger combined with flow/liquidity filters and robust execution is a pragmatic foundation.

From Prototype → Rebuild → Production

- Prototype. Initial validation of the signal, iterative testing of entry/exit rules, and measurement of where slippage and latency had the most impact.

- Rebuild. Migration to TypeScript with modular boundaries: ingest, filters, scheduler, trading engines, metrics, reporting. Emphasis on rate-limit management, RPC failover, and explainable strategies.

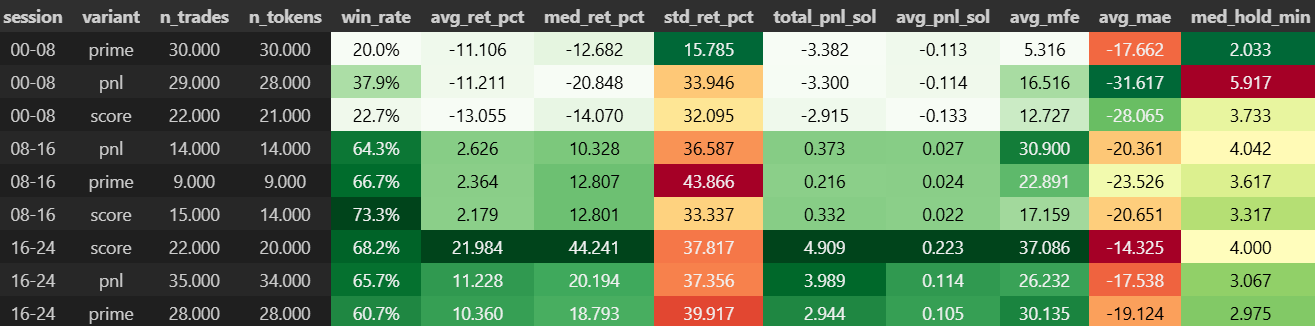

- Production. Fully deployed with observability, periodic summaries, and a feedback loop (paper → reports → notebooks). Recent live periods averaged ~73% win rate with positive PnL distributions.

Core Architecture

High-level system flow:

Ingest → Qualify → Detect → Notify → Trade → Observe

- Ingest. Pull newest tokens and snapshots with pacing/backoff under strict rate limits.

- Qualify. Apply hard gates: minimum market cap, 5-minute volume, buy/sell ratio, minimum buys, optional holder/latency checks.

- Detect. Confirm the curated signal within a global RPM budget.

- Notify. Push alerts, trade lifecycle updates, and performance summaries to Discord.

- Trade. Strategy presets (TP, SL, TSL, timeout). Paper mode for iteration, live mode for execution with guardrails.

- Observe. Prometheus metrics on

/metrics, JSONL/CSV logs, reporting scripts for daily and periodic summaries.

Concurrency & Latency Design

- Budgets and Queues. Global RPM limiter with bucketed schedulers; prevents bursts from starving critical checks.

- Backoff and Pacing. Exponential backoff on 429/5xx, endpoint-specific pacing to maintain stable SLOs.

- RPC Failover. Pool of authenticated RPC endpoints; automatic rotation and re-admission after recovery.

- Priority Fees and Tips. Dynamic estimates (microLamports/CU) with caps; randomized small tips to increase inclusion probability.

- Jitter Protection. Exit rules require consecutive confirmations; sell cooldowns prevent churn in thin liquidity.

- Latency Target. <90 seconds end-to-end under normal load, including detection, decision, and execution.

Strategies & Filters

-

Strategy Presets.

- Baseline: balanced TP/SL with modest timeout.

- Runners: higher TP tolerance with sharper time discipline.

- Fast Scalp: quick TP and timeout for short spikes.

- Trailing Drawdown: trailing SL exits instead of fixed TP.

-

Entry Filters.

- Liquidity: minimum market cap and 5-minute volume.

- Demand: buy/sell ratio, minimum number of buys.

- Optional: holders and latency cap for staleness control.

-

Risk Gates. Optional RSI/EMA bias; simple rug-risk heuristics.

Design Principle: Simple rules coupled with flow/liquidity gates outperform complex models in non-stationary, high-slippage regimes.

Live Execution Layer

- Signal → Buy. Pre-trade quote with price-impact check → slippage-bounded transaction → finalize with compute budget, priority fee estimate, small tip → sign, broadcast, rebroadcast until confirmed. Entry price derived from on-chain balances.

- Position Management. Fixed-cadence polling; retry/backoff quotes; exit decisions with confirmation ticks; persistence of positions for safe restart.

- Logging. Structured logs (

live_trades.jsonl, CSV) for reporting and research.

Deployment & Operations

- Process Manager. PM2 or Docker for resilience;

.envconfiguration with secrets excluded. - Wallet & Fees. Private key or keypair file; dynamic fee estimation with conservative caps.

- Guardrails. Slippage and price-impact caps, partial TP, trailing logic for volatile moves.

- Observability. Metrics at

/metrics, logs to JSONL/CSV, Discord summaries every 4h/12h/daily.

Research & Backtesting Workflow

- Data Capture. Paper trades to JSONL/CSV; live trades similarly logged. Optional high-frequency datasets for post-trigger analysis.

- Reporting. Automated summaries via

npm run report:paperand Discord posts. - Notebooks. Parameter sweeps and HF analysis for continuous strategy refinement.

- Metrics Tracked. Win rate, profit factor, expectancy, time-in-trade, slippage vs. quotes, confirmation latency.

Performance & Lessons

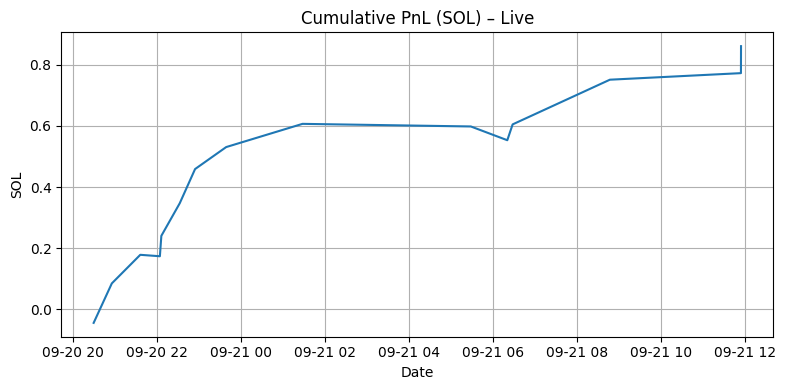

- Results. Recent deployment averaged ~73% win rate with promising cumulative PnL. See Figure 1 for live cumulative PnL curve.

-

Key Drivers.

- Execution reliability (priority fees, tips, rebroadcast) reduced stuck trades.

- Debounced exits + cooldowns reduced slippage and churn in illiquid environments.

- Budgeted schedulers protected API health and reduced detection latency.

- Simple, explainable strategies enabled faster iteration and avoided overfitting.

Figure 1 — Cumulative Live PnL (SOL) Cumulative realized returns across recent live trades. The equity curve reflects both disciplined exits and the benefit of reliable execution under volatile conditions.

Future Improvements

- Adaptive entry filters: thresholds adjusted dynamically with volatility and market conditions.

- Smarter risk heuristics: stronger rug/ownership filters without exposing alpha.

- Multi-wallet execution: staggered entries to reduce footprint and increase inclusion.

- Execution analytics: deeper comparison of quoted vs. realized fills to tune caps dynamically.

Wrap Up

The edge here is not a single secret signal, but the sum of disciplined engineering choices: a discrete catalyst, conservative flow/liquidity gating, simple exits, and serious attention to reliability. In volatile microcap markets, engineering quality often matters more than clever models.

Start in paper mode, measure everything, and avoid overfitting. Build the simple system that survives volatility and slippage before adding complexity.